Law Office of James Hastings PC

sophisticated solutions to complex tax problems

the law office of james hastings uses decades of experience in public accounting, financial statement analysis, income taxation and tax litigation to deliver the best results for our clients

tax litigation

defending state and federal audits from administrative action through tax litigation and appeals

litigation consultingbuilding tax advantaged litigation strategies to ensure

the best outcome for clients

estate and trust litigation

achieving equitable results for probate, trust and estate controversies

estate planning

delivering comprehensive estate and succession planning to individuals and high-net worth families

startup advisor

setting up tax advantaged corporate structures for closely held businesses, startups and founders

"I prefer to work with boutiques. My ideal law firm is a law firm of one...

the accountability is extremely high."

- Naval Ravikant, CEO and co-founder of AngelList

practice areas

James Hastings is a tax lawyer and CPA certified by the California Board of Legal Specialization as a Specialist in Taxation Law. He has more than 25 years experience with accounting, tax compliance, and tax litigation, advising early stage tech companies, startups and founders.

business planning

Throughout his practice, James has advised closely held businesses and technology startups with corporate structures, executive compensation and tax advantaged transactions. This includes raising early funds from investors and counseling owners with growth stage transactions. He has first hand experience as a founder, as well, having taken a two year sabbatical from law practice in 2017 to start Engage for CPAs, a company that built a practice management application for accountants.

tax litigation

Tax litigation starts with a tax notice showing an unfavorable change. The process continues through a labyrinth of administrative procedures and is sometimes resolved only in court. James has represented clients with matters in all stages including the IRS Office of Appeals, the U.S. Tax Court, the U.S. Court of Federal Claims and the California Superior Courts.

estate planning

Tax issues are inherent in estate and trust matters and are especially important to legal disputes. Tax expertise can be a powerful litigation device. In addition to representing both beneficiaries and trustees, James advises high-net worth families with complex multi-generational estate planning and consults on estate and trust litigation issues.

legal consulting

James also advises other attorneys and their clients with particularly complex tax matters. This might include an evaluation of pleadings and settlement agreements to find tax opportunities, helping estate planning attorneys to determine the tax consequences of estate and trust transactions or contingencies, and advising companies on investment and transactions.

representative cases

u.s. tax court litigation

$18.5M tax abatement, U.S. Tax Court

Litigated an innocent spouse claim before the U.S. Tax Court. The IRS Office of Chief Counsel conceded and the court dismissed the case with prejudice, eliminating $18.5M of income tax liabilities, penalties and interest. Pareto Media, Inc., Et Al. v. Commissioner (Consolidated)

estate tax litigation

$1M estate tax recovery, IRS Independent Office of Appeals

Engaged to contest late payment penalties assessed to multi-million dollar estate, arguing that the tax should be abated due to the client's reasonable reliance on the advice of a tax professional. Successfully petitioned the IRS to remove the penalties and refund more than a million dollars of excess payments.

litigation

Accountant's professional negligence, San Francisco Superior Court

Represented the plaintiff with a tax preparer malpractice claim and ten other causes of action related to negligent performance of tax services in connection with delinquent IRS payroll tax and responsible person Trust Fund Recovery Penalties. The case settled for an 11.4x multiplier of the proved special damages. Durham v. Jeffrey Johnston, Game on IRS! (2022)

Accountant's professional negligence, San Francisco Superior Court

Represented the plaintiff with a tax preparer negligence suit related to negligently prepared amended tax returns claiming false or incorrect income tax deductions, creating large tax refunds. The amended returns were reversed in audit, resulting in repayment of the prior income tax refunds created by the false deductions, late payment and accuracy penalties. Recovered a 7.5x multiplier of the proved special damages. Calef v. Jeffrey Johnston, Game On IRS! (2016)

Accountant's professional negligence, San Francisco Superior Court

Represented the personal representative and sole beneficiary who engaged the decedent's CPA to prepare the estate tax return. Identified several significant errors and referred the case to a plaintiff's attorney. Served as both an expert litigation consultant and a fact witness to the litigation and recovered the maximum value of the claim.

Shareholder dispute, breach of fiduciary duty, San Francisco Superior Court

The majority member of a limited liability company tendered an offer to purchase the minority interest. The minority interest holder countered with a suit alleging breach of fiduciary duty and breach of contract, among other claims. Represented the majority shareholder in litigation, ultimately resulting in a settlement agreement to purchase the minority interest for less than the original buyout offer. McNally v. Symbiosystems, LLC, Et. Al.

Litigation consulting, taxation of settlement proceeds, San Francisco Superior Court

Assisted litigation counsel with the pleading, discovery and settlement negotiations to ensure the settlement proceeds were non-taxable to the defendant, resulting in more than $1M of income tax avoided.

estate planningHigh-net worth international estate planning, charitable trusts, Contra Costa County, CA

Advised the decedent with international estate planning and later represented the successor trustee in administering a multi-jurisdictional international estate; created and implemented tax-advantaged strategies to eliminate $95M in federal estate tax while preserving long-term governance, compliance, and charitable objectives.

Multi-generational transfer, appreciated real property, San Francisco County, CA

Represented the beneficiaries of an estate with the transfer a $16M property into subsidiary trusts and used non-taxable transactions and partial disclaimers to structure a tax-advantaged, multi-generational transfer while preserving the original property tax basis.

High-net worth estate planning, conservation easement, Monterey County, CA

Represented the surviving spouse with restructuring investment real estate holdings; prepared supplementary post-mortem estate planning to preserve original property tax basis and avoid capital gain of more than $6M through fractional ownership and conservation easement discounts.

about us

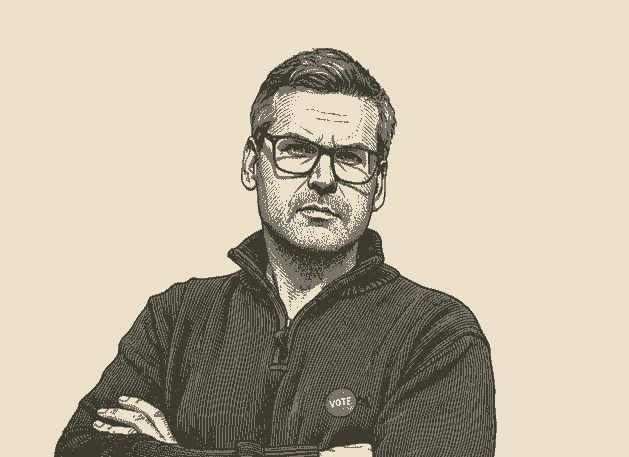

James Hastings

JD, CPA, LL.M Taxation

Certified Specialist in Taxation,

California Board of Legal Specialization

James Hastings has more than 25 years tax experience as a dual licensed professional with the highest credentials in tax law. As a trusted tax advisor to high-net worth families, entrepreneurs and closely held business, his law practice has earned a reputation for creating sophisticated solutions to complex tax questions.

James is also the Co-Founder of Secured Carbon, an AI-driven fintech company automating fund management and capital for energy infrastructure, and Founder of Engage for CPAs, an automated practice management application for CPAs and tax preparers.

Paul H. Nathan, Of Counsel

Paul Nathan is a highly accomplished trial lawyer who graduated cum laude from the University of San Francisco with a Bachelor of Arts degree and recognition on the Dean’s List. He later graduated from the Golden Gate University School of Law and attended Gerry Spence’s Trial Lawyers College. Paul has received the AV Preeminent Award from Martindale Hubbell. He was named one of the “Top Attorneys in California” by San Francisco magazine and maintains an AVVO rating of 10.0.

Additionally, Paul has been honored as one of the Top 100 Trial Lawyers in California by the National Trial Lawyers, received the Litigator of the Year award from the American Institute of Trial Lawyers, and earned the Lifetime Achievement Award from the Premier Attorneys of America.

tax news & insights

- In a historic ruling, the Supreme Court has overturned the Chevron deference doctrine in Loper...The Inflation Reduction Act: A Game Changer for Clean Energy Tax Incentives The Inflation..."I am a plaintiff’s PI attorney, and I was doing some research and saw your article...More Posts

contact information

“Cryptocurrency is everything you don’t know about money combined with everything you don’t know about computers.”

- John Oliver

© 2025